Why Following 'Good' Property Advice Is Costing Singapore Families Their Life Savings

It's Not About the High Prices – It's About What Most Upgraders Don't See Coming

- From Carina & Ray, your HDB upgrading specialists who've been exactly where you are at.

Why HDB Upgraders Following 'Proven' Property Strategies Are Losing $200K-600K

The Repeated Patterns Behind Singapore's Most Expensive Property Mistakes

- From Carina & Ray, your HDB upgrading specialists who've been exactly where you are

"Forensic analysis of multiple MOP waves exposed a consistent pattern that explains why good families make bad property decisions..."

Look, we get it.

Every month you wait, those condo prices seem to climb higher.

That 3-bedroom unit that was $1.5M two years ago? Now it's pushing $2M+.

The pressure to "get in before it's too late" is real.

We've felt it ourselves during our own BTO journey, watching prices move while we waited for our MOP.

But here's what we've discovered after helping hundreds of families just like yours navigate their upgrading journey:

The pressure to "get in before it's too late" is real.

But here's what our systematic analysis of hundreds of upgrader outcomes reveals:

The massive financial losses aren't from market timing.

They're from specific, predictable selection errors that most families never see coming.

Properties that appear identical on standard metrics can experience price performance differences exceeding $362,000 over just 6 years.

This isn't random chance or market volatility.

It's a repeated pattern hiding in plain sight – one that most buyers completely overlook.

Let me show you a real case that transformed how we help HDB upgraders make their most important financial decision:

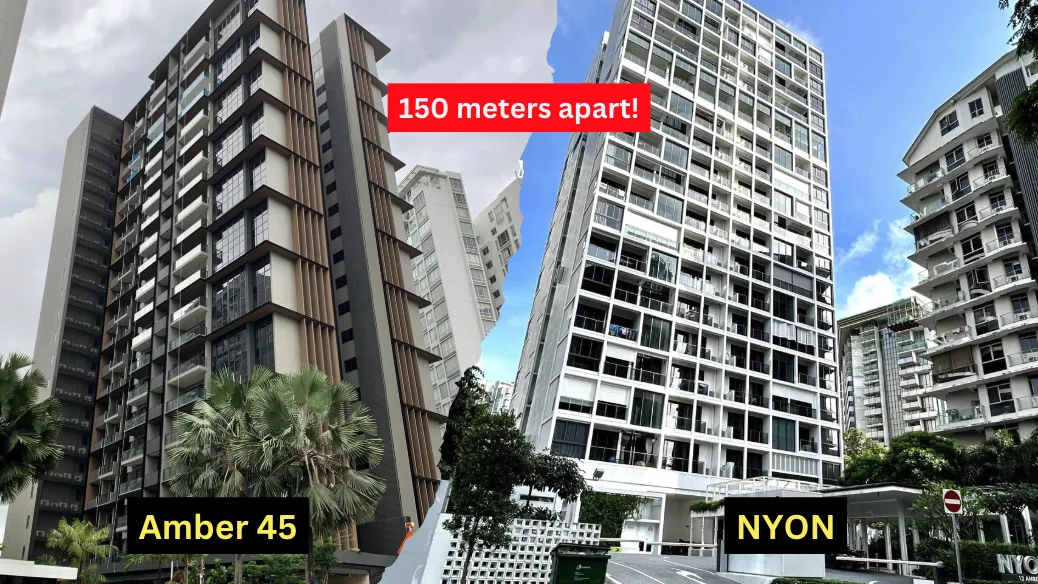

Back in 2018, two families had upgraded around the same time period,

to almost identical 3-bedroom condos just 150 meters apart in Tanjong Katong.

Similar purchase prices, similar circumstances.

Both units had:

→ Similar floor plans and sizes (around 1,200 sq ft)

→ Comparable 6th-floor units with partial sea/city views

→ Same East Coast address near upcoming MRT connectivity

→ Purchased within 9 months of each other, at similar prices (~$2.6M–$2.7M)

Fast forward to when they both needed to sell in 2024:

👉 Family A: Sold for $3.35 million (profit: $630,000)

👉 Family B: Sold for $2.868 million (profit: $268,000)

Same area. Same timeframe. $362,000 difference in their outcomes.

This is a real documented incident.

When we dug deeper, we realized this wasn't bad luck or timing.

There were specific decisions, the seemingly small ones, that created this massive gap.

That's when it hit us:

Most upgrading advice completely misses the things that actually determine whether you build wealth or lose it.

What We Really Wish Someone Had Told Us

You know that overwhelming feeling when everyone's giving you different advice?

"Buy new launch!"

"Resale is better value!"

"Location, location, location!"

"Just get in the market!"

We've been there. During our own property journey, we felt like we were drowning in conflicting information.

But after working with so many families and seeing their real outcomes, we've spotted patterns that most people never notice.

There are a handful of mistakes that keep showing up:

Mistakes that cost families $200,000+ even when they think they're doing everything right.

And we included them in our exclusive report below.

Here's what we've learned to watch out for (that's included in this report):

👉 Why certain developer pricing strategies eliminate appreciation potential before you even get the keys, setting up unsuspecting buyers for years of stagnant growth despite "attractive early-bird discounts"

👉 The proven statistical patterns that predict which new launches will thrive before construction begins, while others in the same district struggle to maintain their launch prices

👉 Why the "land-scarce" narrative creates persistent fear that overrides rational analysis, pushing Singaporeans into hasty decisions that lock in six-figure losses

👉 How families with modest budgets secure properties that appreciate 25%+ while expensive "premium" developments stagnate, defying conventional wisdom about "investment-grade" real estate

👉 Why URA Master Plan "blind spots" consistently cause six-figure losses for even experienced investors who thought they'd done their due diligence

👉 The ripple effect principle that explains why properties just outside major transformation zones often outperform those within them by $200,000+ over a 5-year period

👉 Why market cycle exposure affects different property types unevenly, creating predictable patterns of winners and losers that smart investors use to their advantage

👉 The interest rate vulnerability threshold that determines whether a property remains affordable during rate fluctuations, protecting you from the payment shock that forces distressed sales

👉 The dangerous supply pipeline surprise that has trapped owners in properties with stagnant values for over 7 years, and how to identify this risk before purchasing

👉 How functional living space creates a more accurate calculation of effective PSF than raw numbers, revealing which "good value" properties are actually expensive money pits

This isn't theoretical advice about "buying in good locations" or vague recommendations to "check the URA Master Plan."

It's a detailed, evidence-based framework developed through forensic analysis of thousands of property transactions across Singapore.

The exact methodology that has helped our clients consistently make property decisions they never regret – even during market downturns.

Why "Common Sense" Property Advice Can Be Dangerous Now

Here's something the media won't tell you:

The property market has fundamentally changed since around 2019.

What worked before – that simple "location, location, location" advice – can actually lead you into financial traps now.

What used to work:

🔸 Any decent condo in a good location would appreciate steadily

🔸 You could follow basic guidelines and do okay

🔸 Timing wasn't that critical

🔸 90% of properties saw 5-8% annual growth predictably

What's happening now:

🔸 Supply patterns have completely shifted

🔸 Developer strategies are totally different

🔸 Some "hot" areas are actually oversupply traps

🔸 Economic factors affect different property types in unexpected ways

We've seen so many families follow advice that would have been great in 2015 but is wealth-destroying in 2025.

It's not their fault – most of the information out there just hasn't caught up with how the market really works now.

What We Do Differently (Because We've Been in Your Shoes)

Look, we're not trying to scare you.

We genuinely want to help families make upgrading decisions they'll never regret.

What sets us apart is our forensic accounting background from Ernst & Young – we can spot the financial patterns in real estate that most people completely miss.

But more importantly, we grew up in HDB homes ourselves.

We understand the emotional connection you have to your current home and the dreams you have for your family's future.

We've personally navigated multiple property moves and the anxiety that comes with major financial decisions.

That's why we get that every family's situation is unique, and we're genuinely good at finding real deals while making sure you never overpay.

We've learned that successful upgrading isn't about timing the market perfectly or finding the "cheapest" option. It's about understanding your specific situation and finding properties that work for your family's timeline, budget, and goals.

Our promise is simple:

We'll prioritize your family's interests above everything else.

Every recommendation we make is based on what we genuinely believe will serve your long-term wealth and happiness.

Here's Something That Might Surprise You

Look, we know what you're thinking:

"Of course property agents are going to say there's opportunity in the market right now – they want to sell me something."

And honestly? We get it.

If we were in your shoes, we'd be skeptical too.

But here's the thing – we've actually advised plenty of families NOT to upgrade.

Just last month, we told three different families to wait because their situations weren't right for it.

One couple wanted to stretch their budget beyond what made sense.

Another family's timeline didn't align with what was feasible.

We could have easily pushed them to "upgrade" - but that's not how we sleep well at night.

So when we say there are genuine opportunities right now in the market, it's not because we're trying to sell you something.

It's because we're seeing specific patterns that actually favour families who know what to look for.

Here's what most families don't realize:

Despite all the talk about high prices, while everyone's worried about rising prices, genuine value opportunities are being overlooked.

When there's fear and uncertainty in the market, that's often where the best opportunities hide.

Why?

👉 Sellers become more negotiable.

👉 Emotional buyers stay on the sidelines.

👉 Competition decreases for properties with real fundamentals.

And families who understand what actually drives value can find properties that work for their budgets and goals.

The families who will look back on 2024-2025 as their wealth-building breakthrough aren't those waiting for "perfect" conditions.

They're the ones who learned to spot real value while others were distracted by market noise.

The truth is, we can't create opportunities that don't exist. But we can help you recognize them when they do.

What we've put together isn't about convincing you to upgrade.

It's about making sure IF you decide to upgrade - you do it in a way that builds wealth for your family instead of destroying it.

Because at the end of the day, a happy client who made a great decision is worth more to us than a quick sale that ends in regret.

One Last Thing

That feeling of being "priced out forever"? We've felt it too. It's scary and overwhelming.

But here's what we've learned:

It's usually loudest just before better opportunities appear.

The key is knowing how to recognize them when others can't.

You don't have to figure this out alone.

We're here to help you cut through the noise and focus on what really matters for your family's future.

Copyright 2025. All rights reserved.